SHARE:

Over 14,000 people call O’Brien County, Iowa home. It functions similarly to most rural counties in Iowa, but O’Brien County fields one huge advantage: the stalwart power and financial benefits of wind farms.

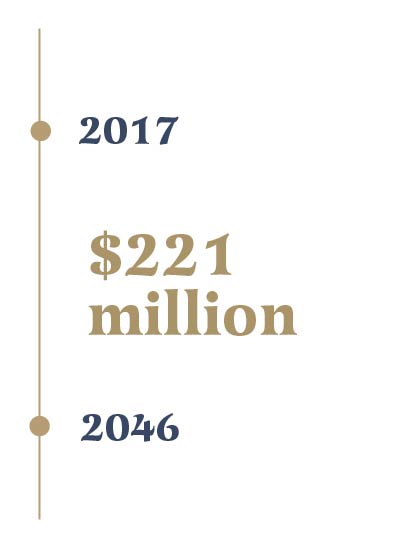

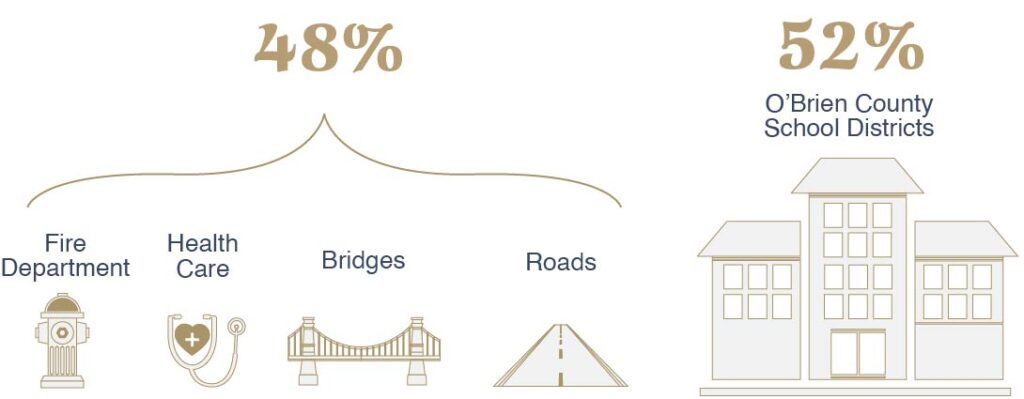

The county supervisors credit wind energy for expanding the county’s tax base and for attracting a younger population due to the creation of new jobs and a consistent revenue source for many farmers and landowners. Between 2017 and 2046, MidAmerican Energy is expected to pay around $221 million in tax payments to O’Brien County. And $42.5 million of it will be received by the county in the first 10 years. The money will directly benefit county citizens, with over 50% of it going into the O’Brien School District alone.

Renewable energy projects can provide significant economic support to the communities they locate in, something that O’Brien County continues to benefit from daily. The county experienced an upturn in economic success brought on by the construction of the projects and subsequent influx of workers. During these three years, hundreds of workers and their families supported and frequented local businesses. Many even chose to stay and continue to call the county home which aided the local real estate market as they rented and purchased local housing. The projects also provide jobs to the county through a continued need for workers who can assist in the projects’ daily operation and maintenance.

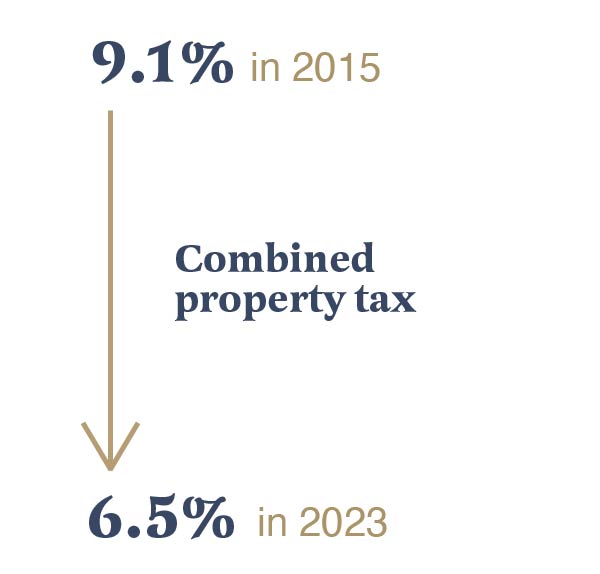

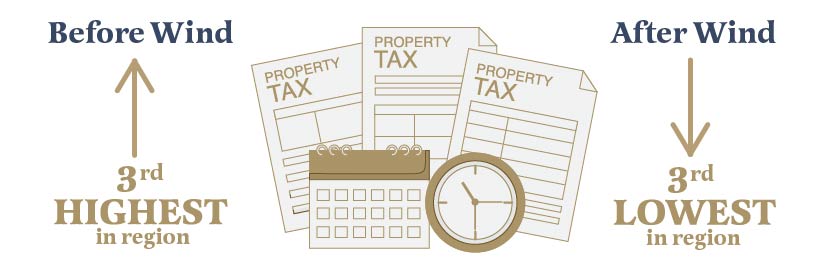

These are just a few of the tangible ways renewable energy projects support O’Brien County and the local community. While other counties around them were raising taxes to offset the tumultuous economy, O’Brien County’s multi-faceted income opportunities enabled it to lower its combined property tax rate from 9.1% to 6.5% from 2015 to 2023. When looking at the region, O’Brien stands out among its eight surrounding counties. This tax rate drop moved them from the third highest rate in 2015 to the third lowest for 2023. That’s a win for the taxpayers and businesses in O’Brien County.

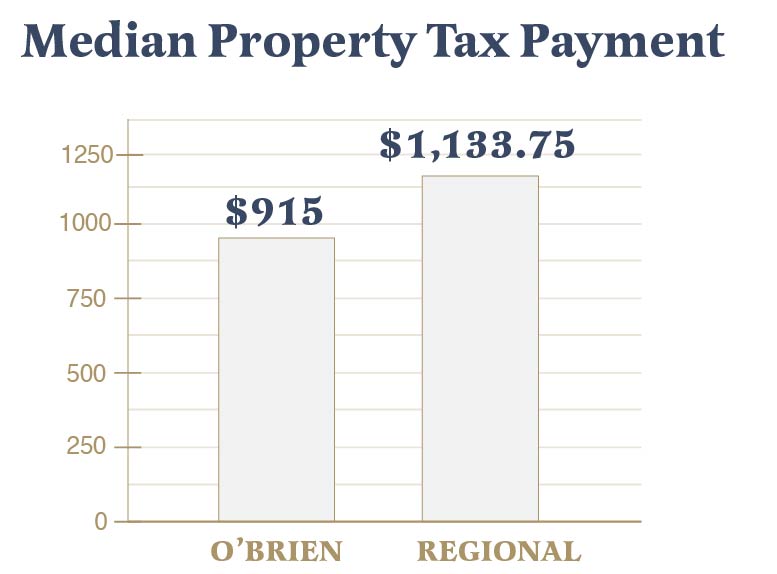

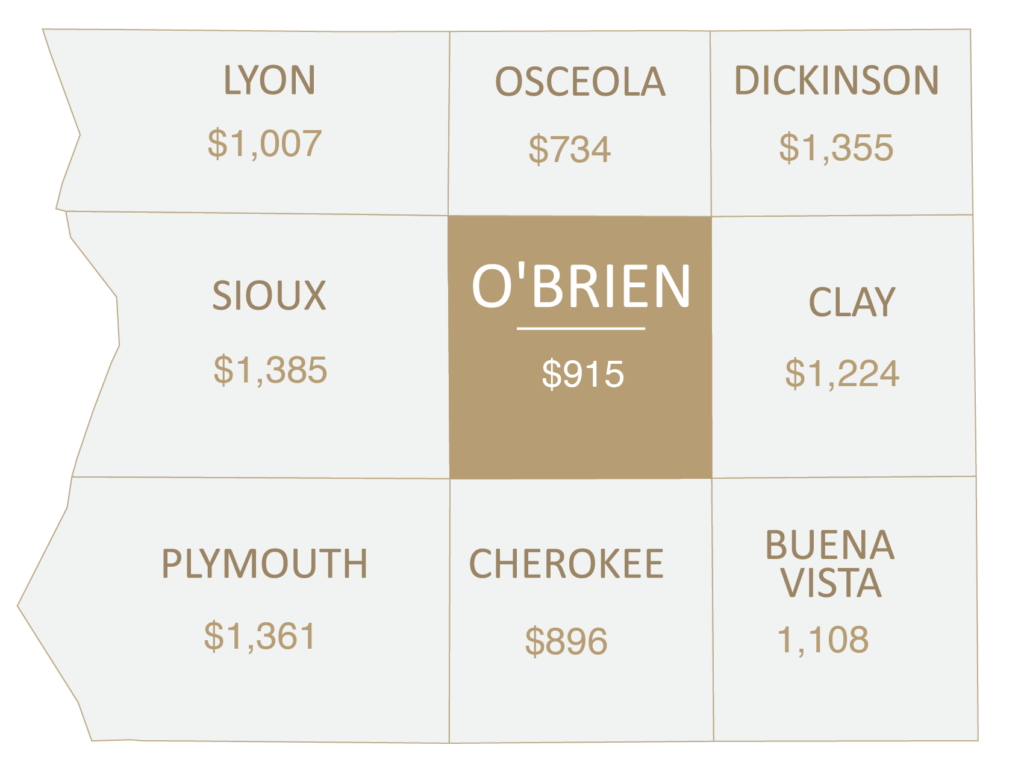

The rate doesn’t tell the whole story, either. Today, O’Brien County has the third lowest median property tax payment of the surrounding counties and their median tax payment is well below the regional average: $915 compared to $1,133.75. Due to the large tax revenue from wind farms, O’Brien County will be able to continue lowering taxes and supporting the county through financial benefits for years to come.

Back in 2003, O’Brien County developed their own wind ordinances which encouraged developers early on to invest in the community. The county is now home to two wind projects, the Highland Wind Project and O’Brien Wind Project, which together can power 225,000 Iowa homes.

Despite the large amount of land, each of the turbines utilize less than an acre of space which allows the county to maintain its rural pursuits as well as opening an avenue for additional income. O’Brien County maintains an emphasis on farming with over 300,000 acres of county land dedicated to it. By harvesting wind energy in addition to other crops, farmers can maintain a consistent weather-proof income.

O’Brien Has The 3rd Lowest Median Property Tax Payment Of Surrounding Counties

County officials’ early adoption of a wind-oriented ordinance protects both citizens who choose to take advantage of this income opportunity as well as those who don’t. Either way, all citizens of O’Brien County reap the benefits of wind energy. Without it, O’Brien County would have been unable to achieve advantages like lowering taxes, aiding their school systems, and giving landowners the opportunity for additional income. All of which attracts more and more people to their community, so O’Brien County can flourish for years to come.

Now you can download the document.

Now you can download the documents.

Now you can download the documents.